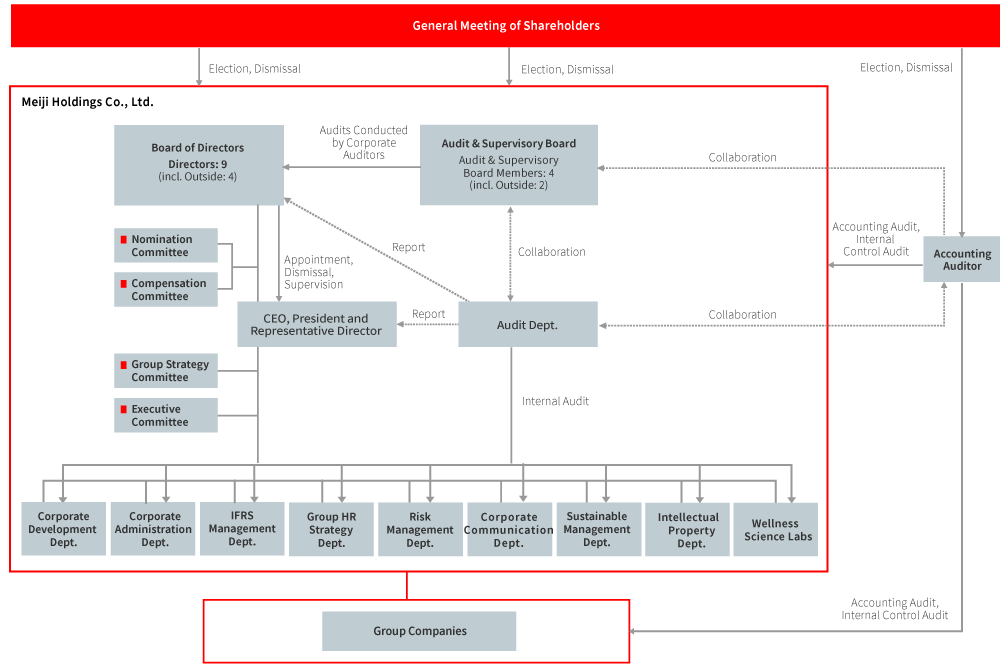

Basic Views

The Meiji Group (the "Group") has created and implements a Group governance structure, which includes our Board of Directors, to promote the realization of medium- and long-term corporate strategy outlined based on our Group Philosophy. The Company is with Audit & Supervisory Board members. The Board of Directors' oversight and Audit & Supervisory Board members' auditing heighten the objectivity and transparency of business management. Our Board of Directors is comprised of diverse directors. The Board deliberates and decides major Group matters, and appropriately monitors to ensure implementation. To improve the efficacy and transparency of the Board of Directors, we have established a system for reflecting the opinions of independent outside directors in management.

On the other hand, concerning business execution, the Company has introduced Chief Officer system to strengthen group management. Serving in the highest positions of responsibility within the Group, Chief Officers supervise and oversee Group business or functions. To promote Group strategy, our Group Strategy Committee, which is comprised of Chief Officers, outlines the direction of important Group matters. Executive Committee, which is chaired by the CEO (Chief Executive Officer) & President, deliberates and decides on important matters concerning strategy implementation, and ensures the rapid and appropriate implementation of operations.

Corporate Governance System

Business Management System Features

The Company is strengthening its corporate governance structure through the following initiatives.

- Appointment of four outside directors and two outside audit & supervisory board members, all of whom are designated as independent directors

- Limitation of the term of service for directors to one year

- Introduction of an executive officer system to separate business execution and audit functions and to accelerate management decisions while clarifying management responsibility

- Introduction of Chief Officer system to strengthen group management. Serving in the highest positions of responsibility within the Group, Chief Officers work in line with basic management policies outlined by the Board of Directors to supervise and oversee Group business or functions.

Board of Directors

The role of the Company's Board of Directors is to formulate and pursue Group-wide strategies, oversee the management of operating companies, and carefully monitor the effectiveness of managers and directors from an independent and objective perspective, with a view to making the Group Philosophy a reality, contributing to the Group's sustainable growth and corporate value over the medium- to long-term, and improving profitability and capital efficiency.

Structure:

We recognize that diversity is an important element of the Group's management strategy. Therefore, while considering diversity such as their nationality, gender, or age, at least one-third of Board of Directors shall be independent outside directors.

Director candidates are chosen considering diversity such as their nationality, gender, or age, and are nominated for their advanced knowledge and expertise in fields needed to realize the Meiji Group Vision 2026. These fields include areas such as business strategy, global business, sales and marketing, finance and accounting, HR and diversity, legal affairs and risk management, corporate communications, and sustainability.

The Board of Directors should be consist of managing directors to oversee core operations, executives to manage operating companies, and non-executive directors including at least one-third of independent outside directors. Currently the number of Board of Directors would be around 10.

The Board of Directors currently consists of four independent outside directors (including two female directors and one foreign director) and five internal directors for a total of nine directors.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 19 of 19 meetings (100%) |

| Inside director | Daikichiro Kobayashi | 19 of 19 meetings (100%) |

| Inside director | Katsunari Matsuda | 19 of 19 meetings (100%) |

| Inside director | Koichiro Shiozaki | 19 of 19 meetings (100%) |

| Inside director | Jun Furuta | 19 of 19 meetings (100%) |

| Outside director | Mariko Matsumura | 17 of 19 meetings (89%) |

| Outside director | Masaya Kawata | 19 of 19 meetings (100%) |

| Outside director | Michiko Kuboyama | 19 of 19 meetings (100%) |

| Outside director | Peter David Pedersen | 14 of 14 meetings (100%) *Attended afer the inauguration on June 29, 2022 |

| Internal audit & supervisory board member | Hiroaki Chida | 19 of 19 meetings (100%) |

| Internal audit & supervisory board member | Takayoshi Ohno | 19 of 19 meetings (100%) |

| Outside audit & supervisory board member | Hajime Watanabe | 19 of 19 meetings (100%) |

| Outside audit & supervisory board member | Makoto Ando | 19 of 19 meetings (100%) |

Evaluation of the Board of Directors

Once a year, the Company analyzes and evaluates the effectiveness of the Board of Directors as a whole, taking into consideration the results of surveys on the role and management of the Board of Directors and problems or issues that the Board faces, including a self-evaluation questionnaire submitted by members of the Board of Directors. The Company then takes remedial measures to address any issues highlighted in the surveys. We work to improve the effectiveness of the Board of Directors neutrally and objectively by having third-party assessments conducted approximately once every three years.

We used an assessment survey questionnaire to collect feedback from each director and each member of the Audit & Supervisory Board.

This questionnaire includes:

- Assessment in line with our own corporate governance policy

- Assessment of the operation of the Board of Directors

- Progress in achieving challenges from feedback items in the previous year

Audit & Supervisory Board

Audit & Supervisory Board work towards sustainable growth and medium- to long-term growth in corporate value as a part in the governance of the Company together with the Board of Directors. Also, Audit & Supervisory Board fulfills the roles and responsibilities from an independent and objective standpoint based on the Company's fiduciary and accountability duties to shareholders.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Internal audit & supervisory board member | Hiroaki Chida | 15 of 15 meetings (100%) |

| Internal audit & supervisory board member | Takayoshi Ohno | 15 of 15 meetings (100%) |

| Outside audit & supervisory board member | Hajime Watanabe | 15 of 15 meetings (100%) |

| Outside audit & supervisory board member | Makoto Ando | 15 of 15 meetings (100%) |

Functions and Roles of any Committee or Other Meeting

| Structure | Functions and roles | |

|---|---|---|

| Nomination Committee | Outside director 4 Inside director 1 The chairperson is elected by mutual vote each time from among members who are independent outside directors. The chairperson is appointed so as not to concurrently serve as chairperson of the Nomination Committee and Compensation Committee. |

Nomination Committee provides the Board of Directors with proposals for the nomination or removal of directors and Audit & Supervisory Board members, and deliberates and advises on the nomination or removal of executive officers, including the president. The Committee also deliberates and advises on matters such as succession plans. |

| Compensation Committee | Outside director 4 Inside director 1 The chairperson is elected by mutual vote each time from among members who are independent outside directors. The chairperson is appointed so as not to concurrently serve as chairperson of the Nomination Committee and Compensation Committee. |

Compensation Committee deliberates on policies regarding the determination of compensation for directors and executive officers, the amount of compensation, the level of compensation, etc., and reports to the Board of Directors. |

| Executive Committee (In principle, the Committee meets twice per month.) | Board members and executive officers | Executive Committee serves as an advisory body to the CEO & President and deliberates important matters related to business execution based on the basic strategic policy outlined by the Board of Directors. |

| The Group Strategy Committee (In principle, the Committee meets once per month.) |

CEO (Chief Executive Officer) CFO (Chief Financial Officer) CSO (Chief Sustainability Officer) COO (Chief Operating Officer) of the Pharmaceutical Segment COO (Chief Operating Officer) of the Food Segment CHRO (Chief Human Resource Officer) |

The Group Strategy Committee applies basic management policy adopted by the Board of Directors towards determining the direction of core matters such as the Group's overall vision, business plans, business policy, and the allocation of management resources. |

In addition to the above, we provide a forum for exchanging opinions between outside directors and outside corporate auditors, which is utilized for the more effective management of the Board of Directors.

Attendance at Meetings

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 4 of 4 meetings (100%) |

| Outside director | Mariko Matsumura | 4 of 4 meetings (100%) |

| Outside director | Masaya Kawata | 4 of 4 meetings (100%) |

| Outside director | Michiko kuboyama | 4 of 4 meetings (100%) |

| Outside director | Peter David Pedersen | 3 of 3 meetings (100%) *Attended afer the inauguration on June 29, 2022 |

| Name | Attendance Rate | |

|---|---|---|

| Inside director | Kazuo Kawamura | 3 of 3 meetings (100%) |

| Outside director | Mariko Matsumura | 3 of 3 meetings (100%) |

| Outside director | Masaya Kawata | 3 of 3 meetings (100%) |

| Outside director | Michiko kuboyama | 3 of 3 meetings (100%) |

| Outside director | Peter David Pedersen | 1 of 1 meetings (100%) *Attended afer the inauguration on June 29, 2022 |

Outside Officer

Reasons of Appointment as Outside Directors

Mariko Matsumura

We appointed Mariko Matsumura as an outside director because her extensive career as a lawyer will enable her to offer professional and insightful advice on company management and to effectively oversee execution of duties. We expect that she will make a significant contribution to the enhancing of corporate governance.

While she has never engaged in company management other than as an outside director or Audit & Supervisory Board Member (Outside), we nonetheless believe she is qualified for the post because of the above reason.

Masaya Kawata

Masaya Kawata has extensive management experience as the former President and Representative Director and Chairman and Representative Director of Nisshinbo Holdings Inc., and accomplishments as well as broad insight. He has promoted the company's group and global management.

We appointed Masaya Kawata as an outside director because his extensive experience, track record, and vast knowledge related to business management will enable him to provide Group management valuable advice and ensure the appropriate monitoring of business execution for our Group. We expect that he will make a significant contribution to enhancing corporate governance.

Michiko Kuboyama

Michiko Kuboyama has vast experience related to product development and marketing through her roles at Kao having worked in the Products Public Relations Center before serving as Center manager and as a communications fellow in the Lifestyle Research Department. We appointed Michiko Kuboyama as an outside director because she will be able to provide Group management valuable advice and ensure the appropriate monitoring of business execution from the perspective of the consumer and a diverse range of other perspectives. We expect that she will make a significant contribution to the enhancing of corporate governance.

While she has never engaged in company management other than as an outside director or Audit & Supervisory Board Member (Outside), we nonetheless believe she is qualified for the post because of the above reason.

Peter David Pedersen

Since fiscal 2021, Peter David Pedersen has provided advice on sustainability management to the Company as an outside expert on the Company's ESG Advisory Board. He has abundant experience at environmental and CSR consulting firms along with deep insights in sustainability management at the global level and training of next-generation leaders. We appointed him as an outside director, expecting that he will contribute significantly to enhancing our corporate governance by providing helpful advice on the Group's management and appropriately supervising the execution of its business operations based on the above experience and insights.

Inaugurated in June 2022

Reasons for Appointment as Outside Audit & Supervisory Board Members

Hajime Watanabe

Hajime Watanabe has a prolific career as an attorney at law and has deep expertise in international business transactional law areas. Due to the reasons above, we appointed him as an Outside Audit & Supervisory Board Member. While he has not been involved in corporate management in the past, except as an Outside Director or an Outside Audit & Supervisory Board Member, we have concluded that he will be able to perform his duties appropriately as an Outside Audit & Supervisory Board Member for the reasons mentioned above.

Makoto Ando

Makoto Ando has built a prolific career and gained deep expertise in both the private sector, working in major audit firms and accounting firms in Japan and overseas as a certified public accountant, and the public sector. Thus, we appointed her as an Outside Audit & Supervisory Board Member. While she has not been involved in corporate management in the past, except as an Outside Director or an Outside Audit & Supervisory Board Member, we have concluded that she will be able to perform her duties appropriately as an Outside Audit & Supervisory Board Member for the reasons mentioned above.

Criteria for Independence

The Company has established Criteria for Independence of Outside Members of the Board and Outside Audit & Supervisory Board Members (Criteria for Independence) as follows.

When an Outside Member of the Board and an Outside Audit & Supervisory Board Member are independent, such Member shall not fall under any of the following categories.

- A person who executes business of the Company or its subsidiary

- A person who executes business of the Company's parent company or a fellow subsidiary

- A party which has material business transactions with the Company or a person who executes business transactions of that party, or a major business partner of the Company, or a person who executes business transactions of that business partner

- A consultant, an accounting expert, or a legal expert who receives a considerable amount of cash or other assets other than compensation as a Member of the Board or an Audit & Supervisory Board Member from the Company (when a party who receives such assets is an organization, such as a corporation or an association, this shall refer to a person who is associated with such organization)

- A person who fell under category 1 above during the ten-year period prior to assuming the position

- A person who fell under category 2, 3, or 4 above during the one-year period prior to assuming the position

-

A relative within the second degree of kinship of a person (excluding a person who does not have an important management position) who currently falls or fell under category 1, 2, 3, or 4 above during the one-year period prior to assuming the position

- "A party which has material business transactions with the Company" is one that received payment from the Company during the latest fiscal year equivalent to 2% or more of the party's annual consolidated net sales or 100 million yen, whichever is greater.

- "A major business partner of the Company" is one that made payment to the Company during the latest fiscal year equivalent to 2% or more of the Company's annual consolidated net sales.

- "A consultant, an accounting expert, or a legal expert who receives a considerable amount of cash or other assets other than compensation as a Member of the Board or an Audit & Supervisory Board Member from the Company" is the one who received cash or assets from the Company during the latest fiscal year other than compensation as a Member of the Board or an Audit & Supervisory Board Member, equivalent to 2% or more of his/her consolidated net sales or 10 million yen, whichever is greater.

Independent Outside Officers who Concurrently Serve at Other Companies

The Company permits independent outside officers to concurrently serve as officers in other listed companies, but only to the extent that they are not prevented from devoting sufficient time and effort required to fulfill their roles and responsibilities as director or Audit & Supervisory Board member of the Company.

Auditing Structure and Audit & Supervisory Board

Internal Auditing Division

We have established an Audit Department (internal audit staff: 7), which reports directly to the CEO, President and Representative Director as an auditing division. This department collaborates with other internal auditing divisions within the Group to conduct internal audits.

Internal auditing divisions hold regular monthly meetings with the Audit & Supervisory Board to share information and exchange opinions on the status of activities. The division works to strengthen cooperation with the accounting auditor by regularly sharing information.

Governance Audits of Overseas Group Companies

For overseas Group companies, generally thought to have higher risks than in Japan, in addition to conventional business audits, we also have established a structure for conducting audits specifically designed to reduce fraud and other management risks (referred to as "governance audits"). Governance audits are generally conducted three to four times a year to confirm frameworks and management related to fraud prevention, including promotion of Meiji Group Code of Conduct, Meiji Group Policy awareness, anti-corruption, the separation of duties, whistleblowing systems, and risk management systems. We use external experts to ensure audit efficiency and efficacy.

Audit results are reported to audited companies and also shared with the Group CEO and other relevant officers, corporate auditors, and each operating company. Through these initiatives, we are working to strengthen our internal systems, and enhance our fraud checks and prevention.

We are planning to conduct governance audits at major overseas Group companies during the period of the 2023 Medium-Term Business Plan.

- FYE March 2022: Conducted governance audits at three locations (Spain, India, and Taiwan)

- FYE March 2023: Conducted governance audits at four locations (Singapore, Thailand, US, and Indonesia)

- FYE March 2024: Planned governance audits at three or four locations

| Independent auditor | Ernst & Young ShinNihon LLC |

|---|---|

| Audit department (internal auditing) | Audit Department |

| Principal meetings auditors attend | Board of Directors, Executive Committee, Audit & Supervisory Board, Audit Department Liaison Meeting, and others |

Remuneration of Officer

Policy on Determining Remuneration (from FYE March 2022)

We changed our policy on determining remuneration in FYE March 2022 as follows. The remuneration amounts determined based on the new policy will be recorded in expenses in FYE March 2023 and after.

Objective of compensation system

From the perspective of expanding and strengthening Group business operations and corporate governance towards achieving our long-term vision, we outline the objectives of our plan for remuneration for directors and corporate auditors as the following.

Objectives of our plan for remuneration for directors and corporate auditors (outlined in FY2011)

- To ensure compensation levels that enable the hiring of elite internal and external personnel, provide motivation, and promotes retention.

- To serve as motivation for achieving short, medium, and long-term targets.

- To ensure appropriate compensation for generated results.

- To fulfill a sense of purpose by sharing accountability for results with shareholders.

- To ensure fair and reasonable practices that enable the fulfillment of accountability to shareholders and all other stakeholders.

Policy on compensation for director

Compensation structure

-Compensation for internal directors is comprised of the following:

- Base compensation: fixed amount that reflects the director's status and responsibilities;

- Performance-linked compensation: amount that varies according to the company and the director's performance in the preceding fiscal year, and thus provides an incentive over the short term;

- Stock-based compensation: linked with the performance of Meiji ROESG®* and Company's stock performance, and thus provides and incentive over the medium- to long-term.

Base compensation and performance-linked compensation are paid in cash. Stock-based compensation takes the form of transfer-restricted stocks.

-In light of their role and independent status, compensation for outside directors is limited to fixed compensation (base compensation) only.

Compensation levels

To ensure compensation levels that enable the hiring of elite internal and external personnel, provide motivation, and promotes retention, we reference the following when determining compensation levels for directors.

(Compensation benchmark source)

-Levels at major Japanese companies as indicated in data from external research firms

-Levels at major manufacturing companies that are similar to Meiji in business scope, operations, and structure.

Compensation governance

The Board of Directors determines the structure for director compensation, the results for company and individual performance, and the amounts of calculated compensation, after hearing the opinion of the Compensation Committee on these matters. The Compensation Committee has the majority of whom are outside directors independent of the Company.

Policy on compensation for corporate auditors

- The amount of compensation for Audit & Supervisory Board members is determined through negotiation with the members concerned, and the amount will be within the limit resolved by the General Meeting of Shareholders.

- In light of their role and independent status, compensation for corporate auditors is limited to fixed compensation (base compensation) only.

Overview of compensation system for directors

Compensation ratio

To increase incentives for improved performance and promote the sharing of interests with our shareholders and stakeholders, we set compensation composition ratio that is approximately a 50-50 mix of fixed compensation (base compensation) in the amount of remuneration upon achievement of medium- and long-term goals. and variable compensation (performance-linked compensation and stock-based compensation).

We apply a higher rate of variable compensation as the rank and position of the executive increases. We set ratios of 43% to 51% for fixed compensation and 49% to 57% for variable compensation.

Furthermore, the ratio of performance-linked compensation and stock-based compensation within variable compensation is 60:40.

Base compensation

Fixed compensation (base compensation) is paid to directors. We determine this amount based on the director's status and responsibilities, and reference compensation levels at major Japanese companies as indicated in data from external research firms as well as compensation levels at major manufacturing companies that are similar to Meiji in business scope, operations, and structure.

Performance-linked compensation

- Objective

To ensure a commitment to the Meiji Group 2026 Vision and the core KPI outlined in our Medium-Term Business Plan, and to increase motivation towards improving performance. - Compensation structure

-The CEO and the COO are evaluated solely based on corporate performance, with compensation comprised of short-term performance-linked compensation and medium- to long-term performance-linked compensation.

-Positions other than the CEO and COO are evaluated based on corporate performance as well as individual performanceVariable compensation (57~49%) Fixed compensation (43~51%) Stock-based compensation Performance-linked compensation Base compensation

Performance indicators Company performance Individual performance Type and weight Short-term performance-linked compensation

-50%Medium- and long-term performance-linked compensation

-50%Evaluation method Fiscal year target evaluation Medium- and long-term target evaluation Target and weight Consolidated

operating profit

-25%ROIC

-25%Consolidated operating profit

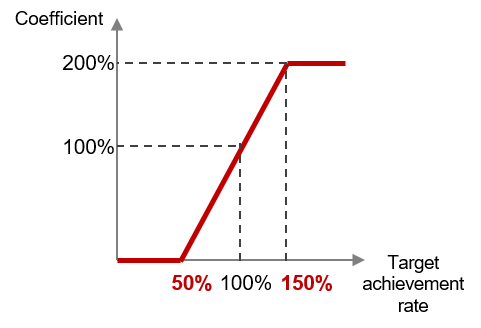

-50% - Short-term performance-linked compensation

Directors (excluding outside directors) are paid short-term performance-linked compensation in the form of compensation that is linked to the level of target achievement for consolidated operating profit and ROIC.

For consolidated operating profit, the payment amount is calculated based on the achievement rate for the fiscal year. When the fiscal year target is achieved, a standard amount is multiplied by the coefficient of 100%.

Depending on the rate of achievement (50% to 150%), the coefficient fluctuates between 0% and 200%.

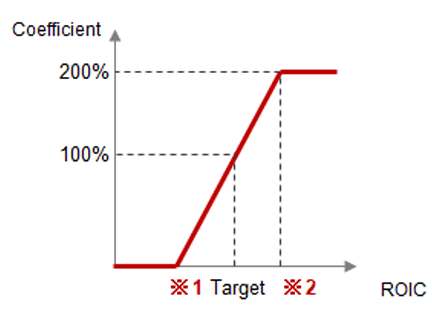

ROIC is evaluated based on performance achievement for that for the fiscal year. At target achievement, a coefficient of 100% is used. Depending on the rate of achievement for annual targets (50% to 150%), the coefficient fluctuates between 0% and 200%. Regardless of target achievement rate, the coefficient is reduced by half if earnings are less than capital costs.

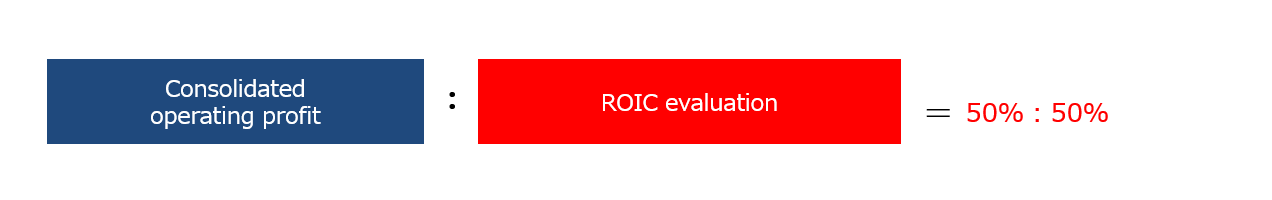

The respective weights for consolidated operating profit evaluation and ROIC evaluation within short-term performance-linked compensation are as follows.[Consolidated op. Profit coefficient] [ROIC coefficient]

- Medium- to long-term performance-linked compensation

Directors (excluding outside directors) are paid compensation linked to achievement rates for medium- and long-term targets, which uses consolidated operating profit as a benchmark, and is set separately from individual fiscal year targets.

When medium- and long-term targets are achieved, the payment amount is calculated by multiplying a standard amount by the coefficient of 100%. This coefficient varies between 0% and 200% based on the rate of achievement for medium- and long-term targets. - Compensation based on individual performance indicators

The CEO comprehensively evaluates individual performance based on a seven-tier scale and calculates payment amounts by multiplying a standard amount by a coefficient that ranges from 0% to 200%.

Furthermore, the CEO and COO are not subject to individual performance evaluations.

Stock-based compensation

- Objective

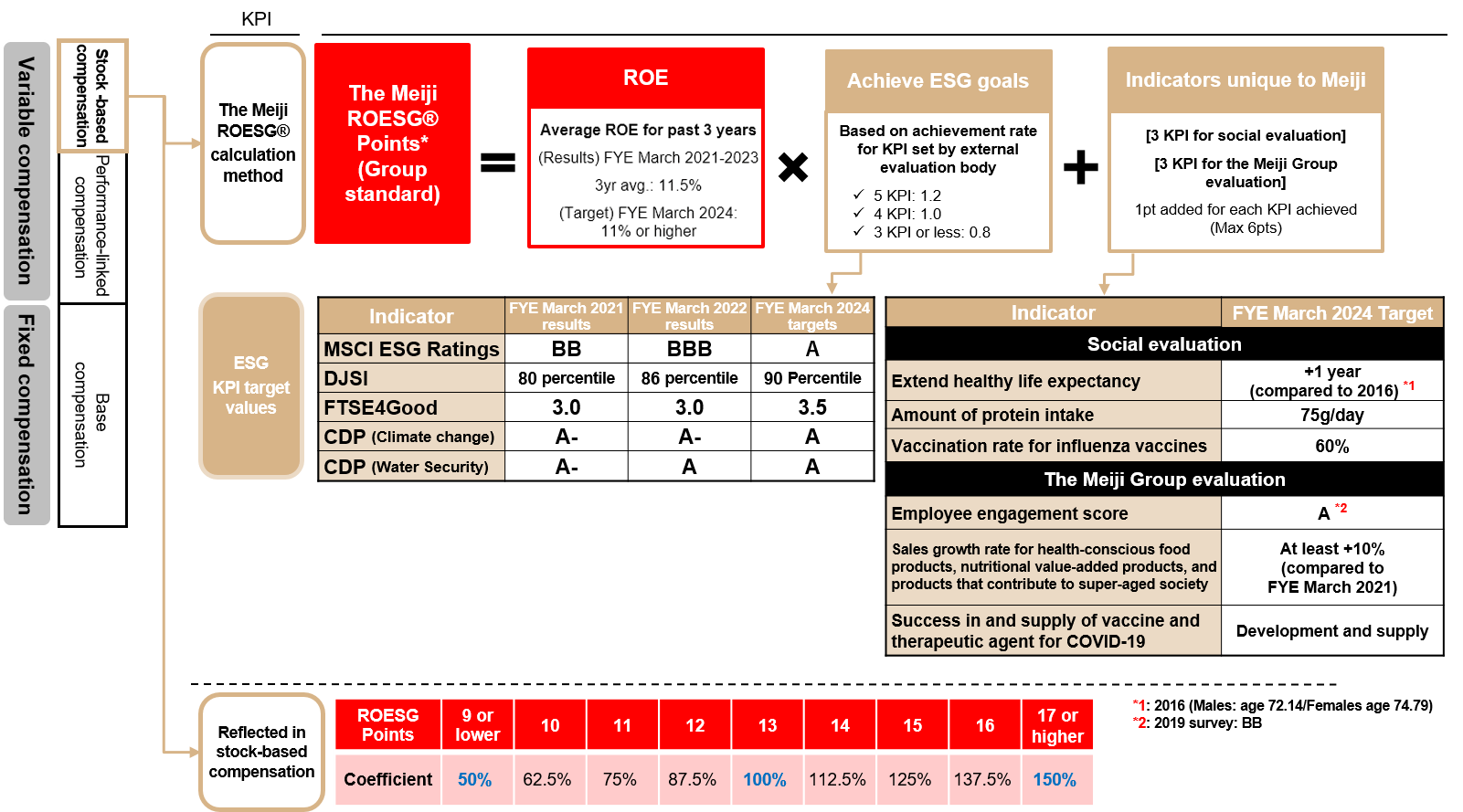

To add incentives for increasing the Group’s corporate value and to promote shared interests between directors and our shareholders and other stakeholders. - Overview

As a medium- to long-term incentive that is linked to trends in our stock, we issue restricted stock that cannot be disposed of for the three-year period following allocation (issued once per year after the General Meeting of Shareholders). The amount of monetary compensation rights paid by the Company for the allocation of restricted stock varies annually and is set based on the results of the Meiji ROESG® from the previous fiscal year. - Payment amount calculation method

We set the Meiji ROESG®, which is calculated based on ROE figures and the results of ESG initiatives, as a performance indicator. The payment amount is calculated by multiplying the base amount by a coefficient calculated as detailed below. :

-We calculate the Meiji ROESG®, which combines ROE and ESG indicators (external evaluations). The coefficient is set to 100% for 13pts. Limited to FYE March 2024, the final year of the 2023 Medium-Term Business Plan, we will add 1pt to the Meiji ROESG® for each item achieved for ESG targets (Unique to Meiji).

-The minimum score for Meiji ROESG® is 9pt and the maximum score is 17pts. The coefficient will vary between 50% and 150% depending on the Meiji ROESG® score.

-No stock compensation will be paid if the Meiji ROESG® score is less than 5pt for two consecutive years. - Details of link to Meiji ROESG®

Audit & Supervisor Board Members

(Nomination Policy)

- Elect persons with excellent character, knowledge, expert skills and a strong sense of ethics. Candidates must be able to provide accurate advice and conduct audits concerning the legality and appropriateness of company operations from an objective and neutral perspective.

- Include at least one person with appropriate knowledge related to finance and accounting.

(Nomination Method)

Nominated via a resolution by the Board of Directors following deliberation by the Nomination Committee and approval by the Audit & Supervisory Board.

(Compensation Structure)

The Company pays fixed compensation only; no incentive remuneration is paid. The amount of compensation for Audit & Supervisory Board members is determined through negotiation with the members concerned, and the amount will be within the limit resolved by the General Meeting of Shareholders.

Succession plan for the CEO and other top executives

Our Board of Directors decides on the succession plan for our Group CEO based on consultation with the Nomination Committee. The Board of Directors outlines implementation strategy for a succession plan based on the parameters (leadership values) required of executives. These parameters are outlined based on our Group Philosophy, our Code of Conduct, and business strategy.

Based on this implementation strategy, the Nomination Committee deliberates on the nomination and removal of the current CEO of the Company and the CEOs of our main Group companies, and selects CEO candidates. The Board of Directors receives regular reports on the status of the succession plan and deliberates on the details of the plan.

Leadership Value describes the standards that our executives must uphold to lead the group toward achieving its vision. The main thing we expect of top executives is the ability to "instigate change and lead reform efforts." To this end, Leadership Value outlines the following 10 competences across three themes:

- Strategic planning and action: Imagination, decisiveness, ability to achieve breakthroughs, ability to channel creative energies

- Organizational leadership skills: Ability to communicate and convince, ability to motivate, magnanimity for others' mistakes, ability to develop others' talents

- Character: Ability to recognize and channel diverse talents, upstanding character

Training Opportunities for Directors and Audit & Supervisory Board Members

The Company provides directors, Audit & Supervisory Board members, and executive officers with training opportunities as necessary to develop their understanding of their legal liabilities and the roles and responsibilities they are expected to perform with respect to corporate governance, compliance, and risk management, as well as opportunities to gain the necessary knowledge on the Group's business lineup, organizational structure, and financial status.

The Company briefs outside officers on the Group's management strategy and business lineup/status to further their understanding of these matters. In addition, outside officers are taken on inspection tours of plants and research laboratories.

Exercise of Voting Rights in Shareholdings

As a rule, we will exercise our voting rights in a company in line with the wishes of the stock issuing company's board of directors. However, we will decline to do so if we think that it would negatively impact the business relationships between our group companies or if it would clearly harm the common interests of shareholders.

Related Party Transactions

Directors and Audit & Supervisory Board members of the Company or a major operating company may not engage in material transactions with the Company or a major operating company without the approval of the Company's Board of Directors. Where such transactions are approved, the status of said transactions must be reported to the Company's Board of Directors.

Internal Control System

We provide products and services to a large number of customers through our food and pharmaceuticals business operations. In accordance with the Corporate Behavior Charter, the Meiji Group has established an internal control system befitting the Group and the Group companies that is based on mutual collaboration and multifaceted checking functions to ensure directors, executive officers, and other employees comply with the Food Sanitation Act, the Pharmaceutical and Medical Device Act, and other statutory laws and regulations and the Articles of Incorporation, thereby ensuring fair and sound business activities firmly rooted in compliance.

Compliance

Meiji Group complies with the laws, regulations and social rules of each country in order to ensure all transactions are proper and to promote fair, transparent, and free competition. To increase awareness and strengthen compliance further, we established internal regulations based on our Corporate Behavior Charter and work to improve internal training. We conduct business holding ourselves to high ethical standards and shall continue to develop to be a company trusted by society.

Risk Management System

The Meiji Group recognizes that risk management is not just for responding when emergencies or disasters occur and severely impact business activities. It is also important to take preventive measures to control and mitigate/avert risks.

In addition, as a company responsible for "food and health" that is directly linked to people's lives, we are maintaining and improving our business continuity plan (BCP) so that pharmaceuticals, powdered milk, liquid food, etc. can be delivered to those who need it even in an emergency.

Basic Policies for Business Continuity Plans

Meiji Group's mission is to continue supplying the products and services our customers need, even in the event of a large-scale disaster. In order to ensure this is possible, we have implemented our Business Continuity Plan in line with the following policies:

- Protect the lives of people involved in Meiji Group's business operations, as well as their families

- Fulfil Meiji Group's social responsibilities

- Minimize damage to business caused by stoppage of operations, or similar causes

Constructive Dialogue with Shareholders

The Company positively and voluntarily engages with shareholders so as to promote constructive dialogue with them. General communication with shareholders is managed by the Investor Relations (IR) Department, which is managed by the director in charge of IR. The Company pursues the following measures for promoting constructive dialogue with shareholders.

- The Company positively and voluntarily engages with shareholders so as to promote constructive dialogue with them. General communication with shareholders is managed by the IR Department, which is managed by the executive officer in charge of IR. To a practical extent, we also engage in dialogue with directors and Audit & Supervisory Board members, including outside officers.

- With the aim of supporting shareholder dialogue, the director in charge of IR organizes liaison meetings with personnel from other departments, including Corporate Planning, Corporate Administration, and Risk Management, so as to share information between the departments.

- . In addition to one-on-one meetings, the Company holds earnings conferences twice-yearly for institutional investors and securities analysts to announce the second quarter and the fiscal year results, as well as small meetings led by the Company President. We also hold earnings conferences with institutional investors and securities analysts at the end of the first and third quarter.

- We work to promote dialogue with individual investors and to inform them about the group's businesses. In FYE March 2022, we held online briefings for individual investors.

- We actively promote ESG dialogue with investors. We hold one-on-one meetings with institutional investors and conferences for institutional investors and securities analysts.

- We provide information via our website for shareholders and investors. We publish our investment securities reports (Japanese/English), earnings flash reports (Japanese/English), integrated reports (Japanese/English), and earnings conference materials (Japanese/English) on this website. We also stream video of our earnings conferences (Japanese/English) and publish a Q&A summary (Japanese/English) to further communication.